Oman in Line for Open Skies with EU

When the European Commission presented its aviation strategy in December 2015, it identified 11 key overseas markets with which it aimed to forge an EU-level comprehensive air transport agreement (CATA). Seven countries in the wider Middle East and North Africa region, all six members of the Cooperation Council for the Arab States of the Gulf (GCC)—Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman—plus Turkey were on the Commission’s wish-list to set up open aviation areas. The bloc’s member states authorized (unanimity of all member states is required) talks with only a handful, namely Qatar, the UAE, Turkey, and Oman.

Four years later, Brussels has concluded a CATA with Qatar and in January started talks with Oman.

The UAE refused to enter into negotiations with the Council of the EU, which represents the bloc’s member countries and decided in July to suspend the mandate with Turkey on political grounds. The Commission also finalized long-lasting on-off talks with Tunisia; however, like the Qatar agreement, this CATA has not yet been formally signed off by the Council and “therefore they can’t be applied,” EU sources told AIN. The reason for the delay is outside the Commission’s control and is due to the bilateral dispute between the UK and Spain over the territoriality of parts of Gibraltar—including the strip of land where the airport was built.

The Gibraltar deadlock has impacted four EU-level comprehensive air transport agreements, confirmed Carlos Bermejo Acosta, deputy director-general responsible for aviation agreements at the European Commission’s department for mobility and transport (DG MOVE). Deals with the Ukraine and Armenia were finalized and initialed in 2013 and 2017, respectively, but they are on hold owing to the Gibraltar dispute, Bermejo Acosta explained during a recent presentation of the state of play of the EU’s air transport agreements to members of the transport committee of the newly elected European Parliament. “We hope this will be solved soon,” he stressed.

When endorsed by the Council, Qatar, and Tunisia will join Morocco, Jordan, and Israel in having an EU-level open skies in the MENA region.

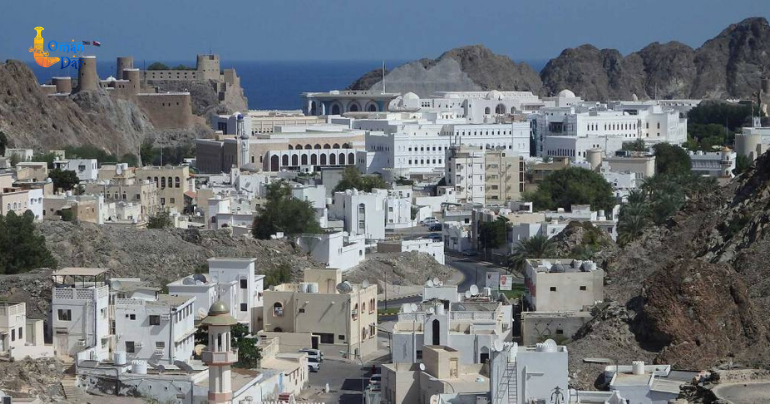

Negotiations with Oman started at the beginning of this year and a third round of talks was scheduled to take place in Oman November 13-14. Good progress was achieved during the second round in June, according to Bermejo Acosta, noting that “the fact that we have concluded an agreement with Qatar makes it easier.”

The Council authorized the European Commission in June 2016 to negotiate an EU-wide aviation agreement with Qatar. After five formal rounds of talks, the CATA was initialed in March this year, marking the first such agreement between the EU and a Gulf country. “Both sides have demonstrated that positive engagement can build trust among nations, so they can embrace the benefits of competition,” Qatar Airways Group Chief Executive Akbar Al Baker commented at the time. “Our hope is that the success of these negotiations will encourage other trading blocs and significant aviation markets to join in achieving a liberalized global aviation regime for future generations,” he added.

The agreement calls for the gradual market opening over a period of five years to the five EU countries which have no bilateral open skies in place with Qatar for cargo and passenger air transport—Belgium, Germany, France, Italy, and the Netherlands. It also contains provisions on fair competition and on social matters, as well as on transparency on international reporting and accounting standards. Qatar committed also to the removal of existing obligations for EU airlines to work through a local sponsor.

According to an EC-commissioned study, the agreement could generate economic benefits of nearly €3 billion ($3.34 billion) over the period 2019-2025 and create around 2,000 new jobs by 2025.

The CATA with Morocco, in place since 2006, has led to a 150 percent capacity growth between the country and the bloc and a doubling of the number of city pairs, to 198 in 2018, European Commission data show. At the same time, average fares decreased by 61 percent, equating to a €172 savings on each ticket. All open skies with the EU—nine are currently applied—have resulted in the growth in passengers and new connections and a decrease in the average cost of a ticket, Bermejo Acosta pointed out. EC analysis estimates the economic benefits of a CATA with all GCC states at €8.4 billion during the first eight years of the agreement.

For the moment, however, it is unclear whether the EU will seek to conclude an open skies arrangement with Saudi Arabia, Kuwait, the UAE, and Bahrain. The political environment in Europe has changed. The Juncker Commission, which was in office from November 2014, planned a new EU executive led by president-elect Ursula von der Leyen, who wants a climate-neutral Europe by mid-century and has defined the “European Green Deal” as a key priority for the next five years. This strategic shift towards a focus on climate action and reduction of greenhouse gas emissions could dim the former Commission’s ambitious external aviation policy to tap into growth markets through open skies deals.

tag: skies , european , avaition , strategy , overseas , commission , strategy , cata , oman , omanday

Share This Post